Idea

Come up with business idea

Name

Come up with business name

Register

Submit registrations, licenses and permits as required

Bank

Open a bank account

That is about as condensed a version of instruction I can give on starting a business and yes, that’s twenty five words including the headings, go ahead and count, I’ll wait…

Each of these items could be expanded upon infinitely, Googling “Everything you need to know to start a business” gave me lists starting at “The One Thing” to “100 things you need to know to start a business” but the list above captures the minimum account of what it takes, at least in the U.S., and it is a great place to begin understanding what could be needed to start a business.

Depending on the complexity of the business idea, the business structure, how friendly your geographic area is to business, you could do all of these items in a matter of one to a few hours or days. Here is an example…

This morning I wake up and come up with an idea to sell t-shirts out of my car and come to your business to do it. I decide to not plan but to just go for it (not recommended). I decide that the name is going to be “TSTG (T-shirts to go)”.

Let’s say I’m in the United States and live in the state of Idaho. It should be noted that businesses in the United States are generally required to register. Most retailers will register within their individual states (you can register in another state, but more on that in another post). In the case of TSTG it would be the Idaho Secretary of State. As far as I know it is always the Secretary of State’s office that has the forms to create a new business and collects the fees for this.

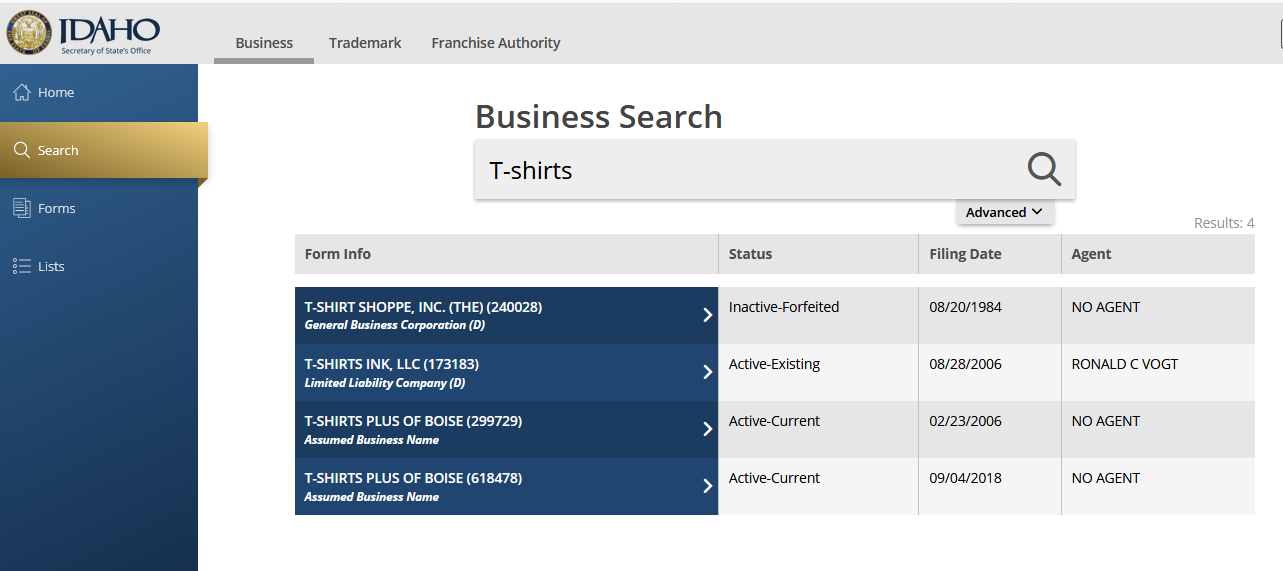

You probably want a unique name for your business so it is a good idea to do a search for the name you want to use before registering it. A lot more can be said on this topic but for now lets keep it simple.

I would have to decide what “type” of business entity my new t-shirt business will be. I could start it as an assumed business name (ABN) or a doing business as (DBA) which only requires a notification filing. I could create an LLC (Limited Liability Company), an LLP if I have a partner, or I could create a “C” corporation, I could even make that C-corp into an S-corp with an IRS filing…yes, it can get confusing so for this post we’ll do the sole proprietorship and file an ABN to keep things simple.

The ABN form will ask me for the name, physical address (no post office boxes allowed) and a few other questions, it will also have a filing fee. In this case it would be $25. The whole process takes about ten minutes for a simple sole proprietorship and I will receive my stamped off copy of the ABN Certificate in the mail in a few days.

Since I will be a retailer selling mostly in Idaho out of the back of my car, for sales tax purposes my next step will be to file for an Idaho sales permit. Basically if you sell anything you need a sales permit, there are some service exclusions but it varies from state to state and certainly from country to country. For this example I would apply at the Idaho State Tax Commission. In Idaho, at the time of this post, the sales permit was free, you only need to register.

Once I have a copy of the ABN Certificate filing from the Secretary of State with their official stamp I can take that copy to the bank and open a bank account with the name TSTG.

Because I am not hiring anyone, that’s it. From this point on I need to buy inventory, start letting folks know about me and maybe do a bit of advertising and drive around selling my products. I need to make sure I keep track of my sales and charge the state sales tax if I sell within the state, which I likely would, and keep the taxes reserved for payment to the state.

It’s a good idea to check with your state, county and city because there are certain cities and counties that levy additional taxes for certain goods and services that you might have to pay if you are located in one of them. For instance if you are in a high tourist area and operate a business you may pay a premium in sales tax, as an example the combined sales tax rate for Sandpoint, ID is 7%. This is the total of state, county and city sales tax rates. The Idaho state sales tax rate is currently 6%. The Bonner County sales tax rate is 0%.

A couple of other points I would make on this very brief business start up overview. You should plan, even if it is a one page plan, figure out your expected costs and sales per period, profit margin and and where your break even points are.

Also, learn what the different types of business structures have to offer you for protection and what is required to maintain that protection for each type of business entity. My assumed business name in this example does not offer me personal liability protection, so if someone sues my business I could be held personally responsible and likely be in a heap of trouble.

from: Northwest Registered Agent LLC (Affiliate Link)

Insurances can also be a good idea. If you are making your own products, do you have product liability insurance? What about general liability insurance? If you were a larger company you might look at Directors and Officers (D&O) Insurance. Lots of things to consider.

This is just an informational post to show how quickly I could set up a business, not all things considered. We hope you enjoyed reading this post, go ahead and register and drop questions into the comments section and we’ll do our best to respond.